Tech-smart, young, and successful, Chris Anderson never thought it would happen to him. He truly believed he was doing everything right to protect his personal information and walked through life with this strong belief. But one unfortunate morning, his world turned upside down.

I know, from personal experience, this is a horrifying situation to be in. Here’s what Chris and I both learned:

The Discovery

A simple text message from his credit card company arrived, asking if he’d just made a $2,000 purchase at an electronics store in Miami. Chris, who lives in Seattle and hadn’t left the city in months, felt his stomach drop. Before he could even respond “NO,” three more alerts pinged his phone — different cards, different charges, all in Miami.

Within hours, Chris discovered the damaging extent of the breach. Someone had:

- Opened five new credit cards in his name

- Applied for a personal loan of $25,000

- Changed the mailing address on several of his existing accounts

- Filed a tax return using his Social Security number

The Aftermath

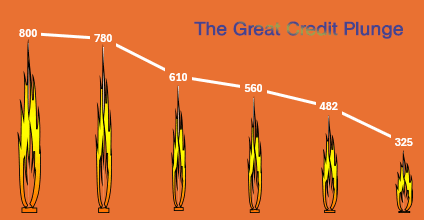

“The next few months were a nightmare,” Chris recalls. His credit score crashed from 780 to 520. He spent numerous hours on the phone with credit card companies, banks, and government agencies. The stress affected his sleep, his work performance, and his relationships. “I felt violated,” he says. “Everything I’d worked for was suddenly at risk, and I had no idea how they’d gotten my information.”

The Investigation

Chris reached out to identity theft specialists to help him. The breach was eventually discovered and was found to have originated through a data leak his local medical clinic suffered a few months back. The thieves had gotten a hold of not just his Social Security number, but also his date of birth, address history, and even his mother’s maiden name — common security questions for financial accounts.

Lessons Learned: Chris’s New Security Protocol

After recovering from the ordeal, Chris developed a comprehensive security system that he wishes he’d implemented sooner. Here’s what he now does to protect his identity:

1. Credit Monitoring and Freezes

“My biggest regret was not having credit freezes in place,” Chris admits. He now:

- Maintains credit freezes with all three major bureaus, temporarily lifting them only when necessary

- Uses a credit monitoring service that alerts him to any changes

- Reviews his credit reports monthly instead of annually

2. Financial Account Security

Chris implemented a new financial security system:

- Created a separate email address used solely for financial accounts

- Set up multi-factor authentication on all financial services

- Uses a password manager to generate and store unique, complex passwords

- Enabled real-time alerts for all transactions over $1

3. Document and Mail Security

Physical security became a priority:

- Purchased a cross-cut shredder for all sensitive documents

- Invested in a fireproof safe for important documents

- Set up informed delivery with USPS to monitor incoming mail (I absolutely love this service: https://www.usps.com/manage/informed-delivery.htm)

- Uses a PO box for sensitive mail instead of home delivery

4. Digital Security Measures

Chris strengthened his digital presence:

- Conducts regular security audits of his online accounts

- Uses a VPN for all internet activities

- Keeps separate devices for financial transactions and general browsing

- Regularly updates all software and security systems

5. Medical Information Protection

Learning from the source of his breach:

- Maintains a list of all medical providers and regularly audits who has access to his information

- Requests detailed records of how his medical information is shared

- Uses a health care proxy service to add an extra layer of verification

Recovery Steps That Worked

For those who find themselves in a similar situation, Chris recommends these immediate actions:

- File a police report immediately

- Contact the FTC and file an identity theft report

- Place fraud alerts with all credit bureaus

- Document everything in a dedicated notebook or digital file

- Set up IRS Identity Protection PIN

- Change all passwords and security questions

- Contact your bank’s fraud department directly

- Monitor your credit reports weekly during recovery

The Silver Lining

“As horrible as the experience was,” Chris reflects, “it taught me valuable lessons about personal security. Now I help others protect themselves before they become victims.”

Chris’s Top Tips for Prevention

- Trust your instincts about suspicious activity

- Don’t delay in responding to security alerts

- Invest in protection services — they’re cheaper than recovery

- Regularly update your security measures

- Keep detailed records of all financial activity

- Be selective about sharing personal information, even with legitimate businesses

Moving Forward

Today, Chris has recovered his credit score and strengthened his financial security. He regularly speaks at community events about identity theft prevention, sharing his story to help others avoid similar experiences.

“Identity theft can happen to anyone,” he warns. “The key is to make it as difficult as possible for thieves and to have systems in place to catch it quickly if it does happen.”

Resources Chris Recommends

- Federal Trade Commission’s Identity Theft Website

- Identity Theft Resource Center

- Annual Credit Report.com

- Consumer Financial Protection Bureau

- Local police department’s fraud division

Remember: The time to protect your identity is before it’s stolen. Don’t wait for a breach to take action.

I’m open to writing for your site, contributing a guest post, or being interviewed for your content. If you’d ever like to collaborate on anything at all, don’t hesitate to reach out, I’d love to hear from you! For the price of a cup of coffee 🍵, you too can help support cybersecurity education for all. Be a winner in the fight against scammers, show your support, and drop me a line letting me know your thoughts or ideas about future posts you’d like to see.

No comments:

Post a Comment