How to spot the difference between charity confusion and criminal intent

Imagine this: Down the street, Mrs. Henderson knocks on your door to collect money for the neighborhood animal shelter. She has the official-looking clipboard, the warm smile, and she even brings up your cat, Fluffy, who enjoys lounging in her garden. You feel good about helping your furry friends as you give them twenty dollars. However, what if Mrs. Henderson only gives five of those dollars and keeps the other fifteen for her “administrative costs”? Is she a skimmer, a scammer, or just a math whiz?

Welcome to the murky world of modern fraud, where the line between well-meaning neighbor and cunning criminal isn’t always crystal clear. In an age where scammers can be anyone from the charming person next door to someone calling from halfway around the world claiming to be a Nigerian prince with a inheritance windfall, knowing who to trust has become a survival skill.

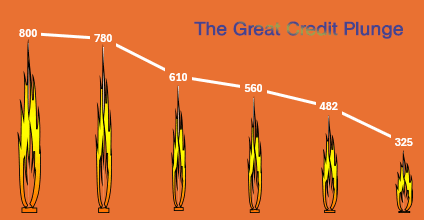

The Great Scammer Spectrum

Not all fraudsters wear metaphorical black hats and twirl mustaches. They exist on a spectrum that would make a rainbow jealous.

On one end, you have the classic “skimmers” — people who dip their hands into funds meant for others but aren’t necessarily criminal masterminds. Think of the PTA treasurer who “borrows” from the bake sale fund to cover groceries, fully intending to pay it back (someday). They’re not quite Robin Hood, but they’re not exactly Al Capone either.

Then there are the full-blown scammers — the professionals who wake up each morning with one goal: separate you from your money faster than a magician makes a rabbit disappear. These folks don’t care if you’re a grandmother living on Social Security or a recent college graduate drowning in debt. Money is money, and they want yours.

When Neighbors Turn Predators

Sometimes the biggest threat comes from inside the neighborhood. Consider Jerry, who’s lived three houses down for fifteen years. He knows you lost your spouse last year, that you’re struggling with technology, and that you trust people who remember your birthday. Jerry also knows you received a substantial life insurance payout. When Jerry starts offering to “help” manage your finances or suggests “investment opportunities” that only he can access, those red flags should be flying higher than a kite in a tornado.

Local scammers are particularly insidious because they exploit something more valuable than money: trust. They’ve shared barbecues with you, borrowed your hedge trimmer, and commiserated about property taxes. But proximity doesn’t equal honesty, and familiarity can breed not contempt, but vulnerability.

The Long-Distance Relationship You Never Asked For

Conversely, international con artists work in a different way. They are not obliged to recall the name of your dog or the preferred coffee shop. They throw wide nets trying to catch anyone who might bite. The fundamental concept is the same regardless of whether the “Nigerian prince” is ringing from an Ohio call center: create a sense of urgency, demand on quick response, and warn dire consequences for nonperformance.

Targeting elderly people, these distant scammers often utilize fantastical stories about unpaid taxes, imprisoned grandchildren, or lottery winnings requiring processing fees. Older folks may be less tech-savvy, more trusting, and maybe even too isolated to have someone on hand to provide a reality check, they know.

The Bank Teller’s Dilemma

Consider yourself as a bank teller when Mrs. Johnson comes to your window. With her phone pressed to her ear, she is obviously upset and requests to take out $8,000 in cash “right now”.” You can hear the aggressive voice on the other end of the line, demanding she stay on the phone and not talk to anyone.

This is fraud happening in real time, and you’re witnessing it unfold. The challenge is interrupting the scammer’s carefully crafted psychological manipulation without embarrassing or alienating the customer. Mrs. Johnson isn’t stupid — she’s scared, confused, and under tremendous pressure from someone who’s very good at their criminal job.

Breaking the Spell

Knowing that someone is being psychologically manipulated rather than merely duped is essential to assisting them in escaping a scam. Scammers are skilled at isolating victims from their support systems, inflating the sense of urgency, and taking advantage of feelings like fear and greed. It takes time, empathy, and occasionally a little creative intervention to get past this manipulation.

In this battle, bank tellers have emerged as unlikely heroes. Nowadays, a lot of banks have procedures for assisting clients and train staff to spot scam situations. Some strategies that are effective:

The “technical difficulty” strategy: “We apologize, but our system isn’t functioning well today. Could you elaborate on this urgent payment while we wait for it to process? These calls aren’t always what they seem.

The “verification” approach: “I am required by bank policy to confirm any significant withdrawals with a supervisor for your protection. After we finish the transaction, would you please hang up and give this number another call?”

The “concerned neighbor” tactic: “I’ve witnessed this exact situation previously, and it didn’t turn out well. Could I show you something that could be useful?

Red Flags That Wave Themselves

Some warning indicators are the same whether the threat is domestic or foreign:

Pressure to take quick action. Reputable organizations don’t need quick fixes to stay out of trouble or face dire repercussions. Gift cards are rarely needed as payment methods for actual emergencies.

Asks to keep things secret. It is a bad sign when someone asks for something and tells you not to tell your friends, family, or bank staff. Someone who is sincere won’t ask you to lie to further their own goals.

Unusual ways to pay. Gift cards, cryptocurrency, and wire transfers to private individuals are not accepted forms of payment by government agencies. Hang up if someone insists on these payment methods while claiming to be from a reputable company.

Opportunities that seem too good to be true. Extraordinary claims necessitate extraordinary proof, whether they come from a stranger promising lottery winnings or a neighbor promising guaranteed investment returns.

The Pause’s Power

Slowing down is sometimes the best defense against scammers. Since urgency is their main tool, scammers detest delays. They want you to respond before you do your homework, act before you consider, and pay before you hesitate.

“I need to think about this” or “I need to discuss this with my family” are frequently the best responses when someone demands quick action. Requests that are legitimate can wait. Fraud cannot.

Developing Immunity in the Community

Collective awareness is necessary to protect our neighbors and ourselves from con artists. Scammers have fewer chances of success when bank tellers are aware of scam scenarios, when family members routinely check on elderly relatives, and when neighbors watch out for one another.

This does not entail becoming suspicious of everyone or paranoid, but it does entail keeping up with typical scam techniques and following our gut when something doesn’t feel right. If something doesn’t seem right, it most likely is.

The Bottom Line

Whether the person trying to separate you from your money lives next door or halfway around the world, their goal is the same: your money in their pocket. The method might differ — neighbors might rely on trust and proximity while international scammers use fear and urgency — but the outcome they’re seeking is identical.

The good news is that knowledge is power, and awareness is armor. By understanding how these schemes work, recognizing the warning signs, and knowing how to respond, we can protect ourselves and help protect others. Sometimes the best way to help someone being scammed is simply to be the voice of reason in a moment of manufactured chaos.

Remember: legitimate organizations and honest neighbors don’t mind if you take time to verify their requests. Scammers, however, hate nothing more than an informed, cautious person who asks questions and refuses to be rushed.

So the next time someone — whether it’s Mrs. Henderson with her clipboard or a voice on the phone claiming to be from the IRS — asks for your money, take a breath, ask questions, and remember that the most expensive thing you can buy is often the thing that seems like a bargain.

Your bank account will thank you.

Maintaining Safety in an Unknown Future

Cybersecurity covers more ground than only shielding from frauds. We have to treat our digital life in the linked world of today with the same care and attention we give our financial security. You need reliable guidance whether your firm is seeking to strengthen its defenses against cyberattacks, a family trying to guard personal data online, or a small company owner concerned about data breaches.

FutureQuestTech knows that cybersecurity shouldn’t be difficult or frightening. Protecting your digital assets starts with knowing the terrain and having trustworthy partners that know you, not just tech jargon; much as spotting a fraudster calls for alertness and common sense.

Our mission is to establish partnerships with actual people and genuine companies based on honest communication, trust, and sensible ideas. Having someone on your side who really cares about your security is not only great but also necessary in a society full of false promises and digital risks.

Visit FutureQuestTech.com or get in touch to discuss your cybersecurity needs to find out more about how we could assist to safeguard your most valuable assets. Sincere information free from sales pressure or deadlines when you are ready for it.